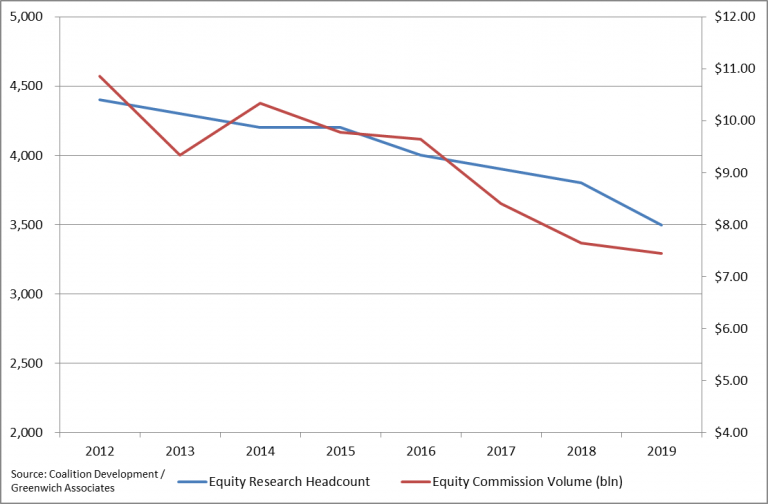

2019 Research Analyst Headcount Shrinks by 8%

2019 Bulge Research Analyst Headcount Shrinks 8% 0BY MICHAEL MAYHEWDECEMBER 30, 2019 Based on data published by consulting firm Coalition Development, research analyst headcount at the twelve largest investment banks dropped 8% to 3,500 by the middle of 2019 across 12 of the largest investment banks. Analyst Headcount Shrinks According to Coalition Development, research analyst headcount at Bank of America, Barclays, BNP Paribas, Citigroup, Credit Suisse, Deutsche Bank, Goldman Sachs, HSBC, JPMorgan, Morgan Stanley, Societe Generale... Read more